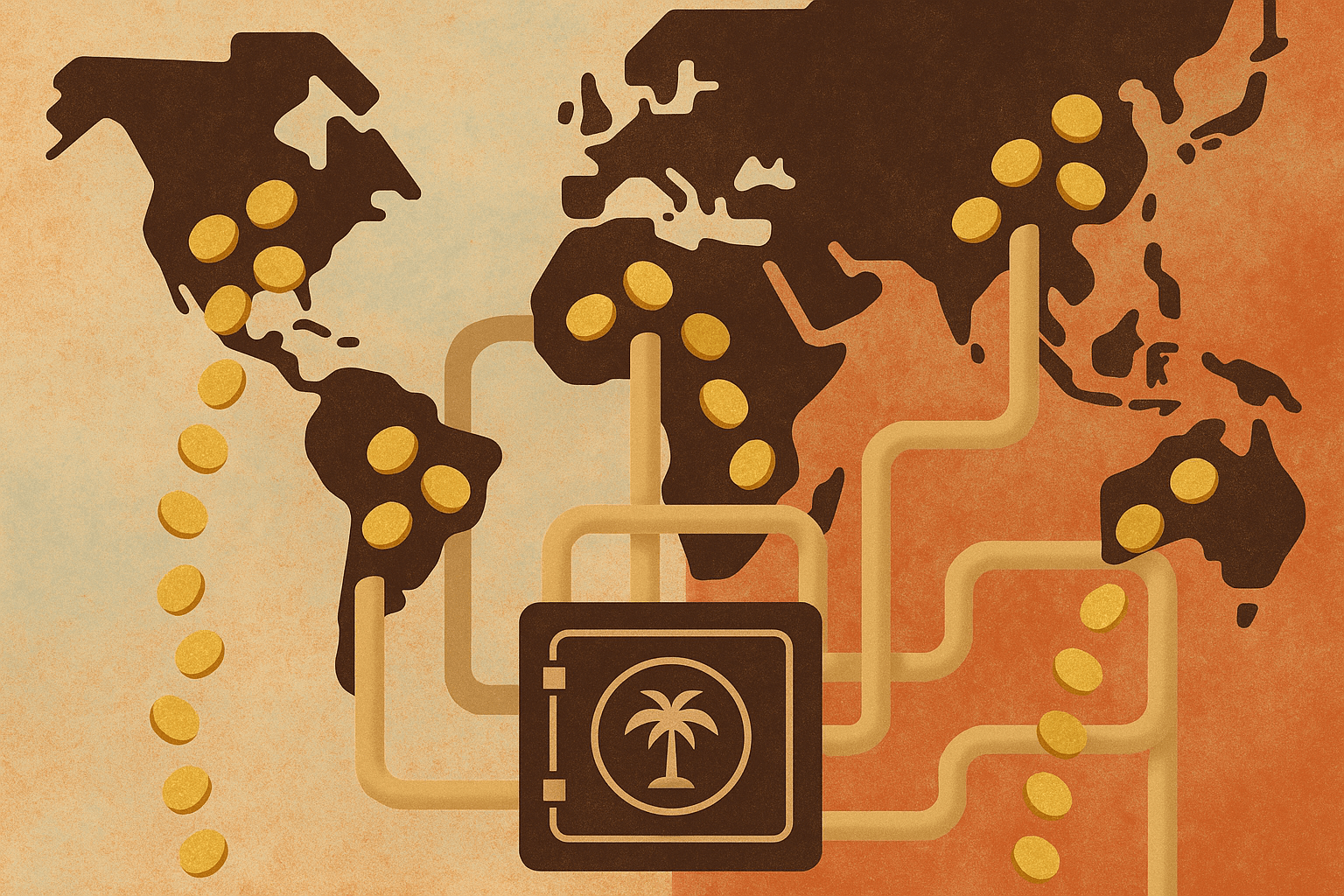

This network is built on the unique characteristics of specific places—their laws, their history, and, most importantly, their geography. To understand tax havens is to understand how a location’s physical and political landscape can be engineered to attract staggering amounts of capital.

What Puts a “Haven” on the Map?

A jurisdiction doesn’t become a tax haven by accident. It meticulously cultivates a set of characteristics that make it irresistible to foreign capital, whether from multinational corporations or wealthy individuals. These features are the bedrock of its geographical appeal.

- A Fortress of Financial Secrecy: The cornerstone of any tax haven is a legal landscape designed to protect the identity of asset owners. This isn’t a physical wall but a legislative one, built from strict banking secrecy laws and policies of non-cooperation with foreign tax authorities. This creates a sovereign “black box” where wealth can be stored away from prying eyes.

- The Lure of a Favorable Tax Climate: The most obvious feature is low or zero taxation on profits, interest, or capital gains for foreign entities. This creates an artificially attractive “economic climate”, encouraging companies to legally register their profits there, even if the real business happens elsewhere.

- The Disconnect Between Place and Profit: A key geographical phenomenon in tax havens is the profound lack of substantive economic activity. Wealth is parked here, not generated here. This leads to surreal urban landscapes, like single office buildings in George Town, Cayman Islands, that serve as the legal “headquarters” for tens of thousands of international corporations—a concept known as “letterbox companies.” This is a stark disconnect between a company’s corporate geography (its legal address) and its economic geography (where its factories, workers, and customers are).

- A Foundation of Stability: Capital abhors chaos. Tax havens must be politically and economically stable to assure clients their assets are safe. This is why many successful havens are either small, stable democracies or territories under the protection of a larger, stable power (like the UK or the US). This stability provides the predictable environment necessary for long-term wealth preservation.

Charting the Archipelago of Secrecy: Key Players and Their Geographical Niches

The geography of tax havens is diverse, with different locations playing distinct roles in the global network. They can be grouped into several key geographical clusters.

The European Hubs: History and Proximity

Switzerland: The grandfather of all tax havens. Its power stems from its unique geography. Landlocked, mountainous, and historically defensible, Switzerland cultivated a “geography of neutrality” that kept it safe during centuries of European conflict. This reputation for stability, combined with its pioneering banking secrecy laws, made its cities like Geneva and Zurich the ultimate safe harbor for global capital.

Luxembourg and the Netherlands: These aren’t remote islands but are geographically central to the European Union. They act as “conduit” or “onshore” havens, using their location within a major economic bloc to their advantage. They specialize in creating legal structures that allow multinational corporations to funnel profits through them, effectively siphoning tax revenue from neighboring high-tax countries like Germany and France. Their power comes from this relational geography—their position relative to other powerful economies.

The British Network: Remnants of Empire

The United Kingdom sits at the center of a web of the world’s most significant tax havens—its Crown Dependencies and Overseas Territories. This network is a direct legacy of the British Empire’s vast geographical reach.

The Channel Islands (Jersey, Guernsey): Located in the English Channel, their geography places them in a unique position—not part of the UK, but dependent on it for defense and international representation. This political ambiguity, combined with their proximity to the financial centers of London and Europe, has allowed them to become premier hubs for sophisticated trust and fund management.

The Caribbean (Cayman Islands, British Virgin Islands): These are the “postcard” tax havens. Their physical geography—small islands with limited natural resources—made offshore finance an incredibly attractive path to prosperity. Their political geography is key: as British Overseas Territories, they enjoy domestic self-governance while benefiting from the stability of the British legal system and Crown protection. This creates a perfect, low-risk environment for parking wealth.

The American Anomaly: Havens in Plain Sight

Perhaps the most surprising part of this map is that some of the world’s most effective secrecy jurisdictions are located within the United States. States like Delaware, Nevada, and South Dakota offer levels of corporate anonymity that rival or even exceed those of traditional offshore havens. The unassuming office building at 1209 North Orange Street in Wilmington, Delaware, is the legal home to over 300,000 businesses, including giants like Apple, Google, and Coca-Cola. This demonstrates that the “geography of secrecy” isn’t just about foreignness; it can be a legal environment cultivated within the borders of the world’s largest economy.

The Ripple Effect: How Tax Havens Reshape Our World

The existence of this global network has profound geographical consequences that ripple across the planet.

First, it creates a distorted map of the global economy. A tech company may generate billions in sales across Europe, but through clever accounting, those profits can be legally recorded in a low-tax jurisdiction like Ireland and then funneled to a zero-tax haven like Bermuda. The economic value is created in one place, but the wealth accumulates thousands of miles away, creating a geographical fiction that masks where economic activity truly occurs.

Second, it acts as a massive drain, siphoning resources from nations rich and poor. For developed countries, it erodes the tax base needed to fund public services like schools, roads, and healthcare. For developing countries, the impact is catastrophic. Tax havens facilitate capital flight, allowing elites and corporations to move wealth generated from a nation’s resources offshore, starving that country of the very capital it needs to build a stable future.

Finally, this hidden wealth reshapes our urban geography. Much of this offshore money flows back into “safe” assets, particularly prime real estate in global cities like London, New York, and Vancouver. This influx of anonymous capital inflates property markets, driving up housing costs for local residents and contributing to urban inequality. The empty luxury skyscraper, owned by an anonymous shell company registered in the BVI, is the physical manifestation of wealth that has traveled through the geography of secrecy.

Understanding tax havens requires us to think like geographers—to see the world not just as a collection of countries, but as a space defined by networks, flows, and the strategic use of place. This hidden geography of wealth is one of the most powerful forces shaping our modern world, and bringing it into the light is the first step toward building a more equitable global economy.